Public finances play a crucial role in determining the economic stability of a country. The management and allocation of a nation’s resources — through government revenue, expenditures, borrowing, and fiscal policy — can have a significant impact on everything from inflation to unemployment, economic growth, and even income inequality. Proper management of public finances ensures that a country can meet its obligations while fostering sustainable economic development, while poor management can lead to economic instability, fiscal crises, and social unrest.

In this article, we’ll explore the relationship between public finances and economic stability, the various components that constitute public finances, and how they influence different aspects of the economy. Additionally, we’ll delve into key strategies and challenges governments face in maintaining fiscal balance and the consequences of poor financial management.

Key Takeaways

- Public Finances Drive Economic Growth: Governments use public finances to stimulate economic activity, promote job creation, and foster innovation.

- Mismanagement Leads to Instability: Poor management of public finances can result in inflation, rising debt, and social unrest, all of which destabilize the economy.

- Balanced Budgets Are Essential: Achieving a balanced budget helps governments avoid excessive borrowing and reduce the risk of a fiscal crisis.

- Sustainable Debt Management Is Crucial: Governments must manage national debt effectively to prevent fiscal crises and maintain investor confidence.

- Strategic Public Spending Promotes Stability: Prudent public spending and investment in essential services can create long-term economic stability.

What Are Public Finances?

Public finances refer to the financial activities of the government, including its revenue, expenditure, and borrowing. These activities are central to the government’s ability to provide public goods and services, maintain infrastructure, implement policies, and address macroeconomic imbalances. Public finances involve three main components:

- Revenue: The money the government collects, mainly through taxes such as income tax, corporate tax, value-added tax (VAT), and custom duties. Other sources of revenue can include dividends from state-owned enterprises, royalties from natural resources, and foreign aid.

- Expenditure: The funds the government spends on various programs and services, including healthcare, education, defense, infrastructure, social security, and welfare programs.

- Borrowing: When the government’s expenditures exceed its revenues, it borrows money to cover the deficit. Borrowing can be done through issuing government bonds, obtaining loans from international organizations, or from domestic financial institutions.

The balance between these components is vital for maintaining fiscal health, ensuring economic stability, and avoiding unsustainable debt levels.

The Relationship Between Public Finances and Economic Stability

Economic stability refers to the smooth functioning of a country’s economy, with consistent growth, low inflation, low unemployment, and balanced trade. Proper management of public finances is essential in promoting this stability. Here are some ways in which public finances impact economic stability:

1. Influence on Economic Growth

Public spending plays a vital role in stimulating economic growth. Governments use their fiscal policies — a combination of taxation and expenditure — to influence aggregate demand within the economy. For example, during an economic downturn, governments may increase public spending (fiscal stimulus) on infrastructure, welfare, and other projects to stimulate demand and create jobs. This, in turn, can spur economic activity and reduce the risk of a prolonged recession.

Conversely, if public spending is mismanaged or excessively high, it can lead to inflationary pressures, which can destabilize the economy. For instance, too much borrowing can drive up interest rates, crowding out private investment and slowing down economic growth.

2. Control of Inflation

Inflation is one of the primary indicators of economic instability, and public finances have a significant impact on inflation rates. Governments use fiscal policy to control inflation by regulating spending and taxation. If a government runs large deficits or borrows excessively, it can lead to an increase in the money supply, which may contribute to inflation. On the other hand, careful management of public finances, including controlling spending and increasing taxes when necessary, can help keep inflation in check.

Additionally, controlling inflation is critical for maintaining the purchasing power of citizens. High inflation can erode real wages and savings, causing a loss of confidence in the currency, which, in turn, can destabilize the economy.

3. Government Debt and Fiscal Deficits

One of the most critical aspects of public finances is the management of national debt. When a country’s government runs large fiscal deficits (where expenditures exceed revenues), it may resort to borrowing to cover the shortfall. Over time, excessive borrowing can lead to an unsustainable debt burden. High levels of national debt increase the cost of borrowing as lenders demand higher interest rates due to the perceived risk of default.

Unsustainable public debt can lead to a fiscal crisis, in which a government struggles to meet its debt obligations, triggering defaults, currency devaluation, and loss of investor confidence. For example, countries like Greece and Argentina have experienced severe economic crises due to high public debt levels, leading to austerity measures and economic contraction.

4. Unemployment and Social Welfare

Government expenditure also plays a crucial role in addressing unemployment. During times of economic instability, governments often step in with social safety nets, unemployment benefits, and retraining programs to help individuals who lose their jobs. These measures not only support individuals but also contribute to social stability by reducing poverty and inequality.

However, excessive spending on welfare programs without corresponding revenue can lead to fiscal imbalances. If the government relies too much on debt to finance these programs, it could lead to unsustainable fiscal policies, which may eventually lead to economic instability.

5. International Trade and Currency Stability

Public finances also affect the exchange rate and trade balance of a country. Countries with large fiscal deficits may experience depreciation of their currency, as foreign investors become wary of lending to or investing in a country with unstable finances. Currency depreciation can lead to higher import prices, leading to inflationary pressures, and can make the country less competitive in international trade.

Countries that have stable and sustainable public finances are more likely to maintain a stable currency, which can help promote international trade, reduce the cost of imports, and attract foreign investment. Conversely, fiscal mismanagement can lead to trade imbalances, affecting the overall economic stability.

Government Strategies to Ensure Fiscal Stability

To maintain economic stability, governments implement various strategies for managing public finances. Here are some key strategies:

- Balanced Budgets: Governments aim to achieve a balanced budget, where revenue equals expenditure. This helps prevent excessive borrowing and reduces the risk of accumulating high levels of public debt.

- Diversification of Revenue Sources: Governments diversify their revenue streams to ensure stable income. This includes taxes on income, consumption, and business profits, as well as non-tax revenues such as natural resources and state-owned enterprises.

- Fiscal Consolidation: During times of economic instability or fiscal deficits, governments often adopt fiscal consolidation measures, which include reducing public spending, increasing taxes, and prioritizing debt repayment. The goal is to restore fiscal balance and reduce reliance on borrowing.

- Public Debt Management: Countries with high debt levels often implement policies to manage and restructure their debt to reduce borrowing costs. Debt management strategies include negotiating with creditors, extending repayment periods, or using fiscal tools to stabilize debt.

- Economic Diversification: To reduce reliance on external factors such as commodity prices or foreign investment, governments may focus on diversifying the economy. This can create a more resilient economic system that is better able to withstand external shocks.

Key Strategies for Maintaining Economic Stability Through Public Finances

Governments must employ effective fiscal strategies to maintain economic stability. Some key strategies include:

- Balanced Budgeting: Striving for a balanced budget is vital for ensuring that public spending aligns with government revenues. A balanced budget helps prevent excessive borrowing and debt accumulation.

- Economic Diversification: Reducing dependence on specific industries or commodities helps insulate the economy from external shocks. Diversified economies are more resilient to market fluctuations and contribute to long-term growth.

- Sustainable Public Debt Management: Governments must implement responsible borrowing strategies and manage their debt burden effectively to ensure long-term fiscal sustainability. This includes negotiating better debt terms and restructuring existing debt if necessary.

- Counter-Cyclical Policies: Governments can implement counter-cyclical fiscal policies to stabilize the economy during recessions. By increasing public spending during economic downturns and cutting back when the economy is booming, governments can help mitigate the effects of economic cycles.

- Efficient Allocation of Resources: Ensuring that public spending is allocated efficiently to productive sectors—such as education, healthcare, and infrastructure—is crucial for fostering long-term economic stability.

Public Finances and Economic Stability: A Deeper Dive into Key Concepts

Public finances do not only influence a country’s fiscal health; they also shape its long-term economic trajectory. Understanding how public finances contribute to economic stability is crucial for both policymakers and citizens. In this section, we explore additional insights into how government financial practices, such as tax policies, public debt, and expenditure allocation, impact broader macroeconomic conditions.

Tax Policies and Their Economic Influence

Tax policies are a fundamental aspect of public finances. The structure, rate, and efficiency of taxation directly affect economic stability. A robust taxation system ensures that the government collects enough revenue to fund essential services and infrastructure while minimizing the negative impact on economic growth.

Progressive Taxation vs. Regressive Taxation:

- Progressive taxation involves higher taxes for those with greater income, helping redistribute wealth and fund public services. This system is vital for addressing economic inequality, providing social security, and ensuring that wealthier individuals contribute more to the economy.

- Regressive taxation, such as consumption taxes (e.g., sales taxes), disproportionately affects lower-income households, as they spend a larger percentage of their income on taxable goods and services.

A balanced tax policy that supports economic development while ensuring social equity is necessary for maintaining public trust and economic stability. Effective tax collection mechanisms can also help minimize the reliance on borrowing, reducing the risk of high public debt levels.

Public Investment: The Role of Infrastructure Spending

Public investment in infrastructure—such as transportation networks, energy systems, healthcare facilities, and education—is one of the most direct ways a government influences long-term economic stability. These investments not only create jobs and boost demand in the short term but also promote productivity and economic growth over the long haul.

Short-term vs. Long-term Economic Benefits:

In the short term, infrastructure projects create employment opportunities and stimulate demand for goods and services, contributing to economic recovery during a downturn. Over the long term, infrastructure enhances productivity by improving access to markets, facilitating trade, and lowering the cost of doing business. Roads, bridges, airports, and utilities are essential for connecting people to opportunities and fostering a competitive economy.

Additionally, public investment in healthcare and education can improve human capital, providing a better-skilled workforce that can drive innovation and productivity growth. Investing in sustainable infrastructure, such as renewable energy projects and green technologies, can further help mitigate environmental challenges while supporting economic growth.

The Role of Social Security Programs in Economic Stability

Social security programs are designed to protect citizens during periods of unemployment, illness, or retirement. These programs, such as pensions, disability benefits, and unemployment insurance, provide a safety net that helps stabilize consumption patterns, reduce inequality, and support economic stability.

Maintaining Social Stability:

During economic crises, social security programs act as automatic stabilizers. When the economy falters, individuals who lose their jobs or face health issues may struggle to maintain their standard of living. By providing financial assistance, the government ensures that people can continue to participate in the economy, preserving demand for goods and services. This, in turn, mitigates the severity of recessions and helps the economy recover more quickly.

However, social security programs require careful funding and management. Unsustainable funding, particularly if reliant on borrowing, can strain public finances, leading to larger deficits and debt. Governments must balance the need for robust social programs with the necessity of maintaining fiscal health.

The Impact of Foreign Aid and International Loans on Public Finances

For many developing countries, foreign aid and international loans play a significant role in public finances. These financial resources can help stabilize the economy, build critical infrastructure, and foster development. However, external debt and aid dependence can also create vulnerabilities that affect economic stability.

The Dual Nature of External Financing:

- Positive Impact: Foreign aid and loans can provide much-needed capital for projects that drive economic growth, such as building schools, hospitals, or energy facilities. When invested wisely, these resources can foster long-term development and reduce poverty.

- Risks: Relying too heavily on foreign loans can increase the risk of default and financial instability, especially if the country faces economic shocks or global downturns. High debt servicing costs can also crowd out funding for other critical domestic programs, undermining social and economic stability.

Governments need to be strategic in managing foreign aid and loans. It is important to ensure that they are used for productive investments and that repayment plans are sustainable. Furthermore, it is crucial for countries to build strong institutions capable of managing external financing effectively and transparently.

Public Sector Efficiency and Economic Growth

The efficiency of public sector administration plays a crucial role in shaping economic stability. The ability of a government to manage its finances effectively—collect taxes, allocate spending, and prioritize investments—has a direct impact on national economic outcomes.

Wasteful Spending vs. Productive Investment:

Governments must prioritize investments that yield high returns, such as education, healthcare, and infrastructure, while cutting back on wasteful or inefficient expenditures. Poorly managed public finances can lead to corruption, misallocation of resources, and inefficiency, ultimately stalling economic growth.

Public sector reform efforts focused on improving governance, enhancing transparency, and reducing corruption are essential for ensuring that public funds are used to their fullest potential. Efficient public service delivery can also help increase investor confidence and support private sector development.

Global Economic Interdependence and Public Finances

In an increasingly globalized world, public finances are influenced by international factors. Global trade, foreign investments, and international financial markets can have a profound effect on a country’s fiscal policies and economic stability.

Capital Flows and Currency Fluctuations:

Changes in global financial markets can impact the cost of borrowing and exchange rates. A rise in global interest rates may increase the cost of government debt, while fluctuations in exchange rates can affect the cost of imported goods and external debt servicing. Governments must manage public finances with an awareness of global economic trends and the potential risks posed by global economic shifts.

Additionally, trade policies, such as tariffs and trade agreements, can directly impact the flow of goods and services across borders, affecting national income and government revenue. As global supply chains become more interconnected, governments must work to ensure that their fiscal policies are adaptable to changing international dynamics.

Also Read: What Is The Role Of The Government Finance Department In National Economic Planning?

Conclusion

Public finances are a cornerstone of economic stability. Proper management of revenue, expenditure, and borrowing allows governments to create conditions for sustainable growth, control inflation, and support job creation. Mismanagement, on the other hand, can lead to fiscal crises, debt defaults, inflation, and even social unrest. Governments must adopt strategies that balance fiscal responsibility with the need to stimulate economic growth, invest in public services, and ensure social welfare.

A nation’s economic stability depends on its ability to manage public finances effectively, with an emphasis on sustainable debt levels, diversified revenue streams, and fiscal policies that promote growth and stability. The choices governments make in managing public finances have far-reaching consequences, both for the economy and for the well-being of their citizens.

Frequently Asked Questions (FAQs)

What is the role of taxation in public finances?

Taxation is a primary source of revenue for governments. Taxes are used to fund public services such as healthcare, education, infrastructure, and social programs, playing a central role in managing a country’s fiscal health.

How does government debt affect the economy?

High levels of government debt can lead to higher interest rates, inflation, and reduced investor confidence. If debt becomes unsustainable, it can trigger a fiscal crisis, leading to defaults and economic instability.

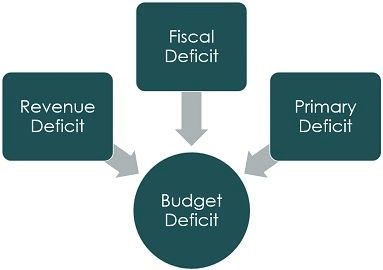

What are fiscal deficits?

A fiscal deficit occurs when a government’s expenditure exceeds its revenue. The government may borrow money to cover the deficit, but if deficits persist, they can lead to higher debt levels and affect the overall economic stability.

Can a country’s economic stability be affected by international debt?

Yes, borrowing from international sources can impact economic stability. Excessive foreign debt can lead to currency depreciation, inflation, and loss of investor confidence, all of which can destabilize the economy.

How can public finances be restructured during a crisis?

Governments can restructure public finances by implementing austerity measures, reducing public spending, increasing taxes, and negotiating with creditors to manage debt more effectively.

What happens when a government runs a budget surplus?

A budget surplus occurs when a government’s revenue exceeds its expenditures. Surpluses can be used to pay off debt, save for future needs, or fund additional public services.

How does public spending affect inflation?

Excessive public spending can lead to inflation, especially if financed by borrowing. If the money supply increases significantly, it can reduce the value of the currency, leading to higher prices for goods and services.