Financial analysis is the backbone of investment decisions. Whether you’re evaluating a company’s health, predicting stock performance, or analyzing a potential merger or acquisition, knowing how to interpret financial data is crucial. While there are countless ways to conduct financial analysis, a few techniques stand out as essential tools for any investor.

In this article, we’ll dive into the top financial analysis techniques every investor should know. From fundamental analysis to advanced metrics and ratios, we’ll explore the tools you can use to make informed investment decisions.

Key Takeaways

- Ratio analysis is an essential tool for assessing a company’s financial performance across various metrics.

- Discounted Cash Flow (DCF) analysis is a robust method for valuing companies based on future cash flows.

- The Price-to-Earnings (P/E) ratio is a quick way to assess the valuation of a company’s stock.

- Comparing a company to its peers using Comparable Company Analysis helps gauge whether a stock is undervalued or overvalued.

- Understanding qualitative factors like SWOT and financial forecasting adds depth to your financial analysis.

Understanding Financial Analysis

Financial analysis is the process of evaluating financial statements, reports, and other relevant data to assess a company’s performance and make predictions about its future potential. For investors, financial analysis helps to determine whether an investment is worth pursuing. It enables them to spot red flags, identify growth opportunities, and evaluate risk.

Key Components of Financial Analysis:

- Income Statement: Shows a company’s revenues, expenses, and profits over a specific period.

- Balance Sheet: Presents a snapshot of a company’s assets, liabilities, and shareholders’ equity.

- Cash Flow Statement: Provides information about the cash inflows and outflows from operating, investing, and financing activities.

While understanding these components is important, the key to successful financial analysis is knowing how to use them in combination to evaluate a company’s overall financial health.

Ratio Analysis

One of the most widely used techniques in financial analysis is ratio analysis. Ratios help simplify the interpretation of financial data by comparing different figures to assess performance, liquidity, profitability, and efficiency. Some essential ratios include:

a. Liquidity Ratios

Liquidity ratios measure a company’s ability to meet short-term obligations. Key liquidity ratios include:

- Current Ratio: Current Assets / Current Liabilities

- Quick Ratio: (Current Assets – Inventory) / Current Liabilities

The current ratio shows if the company can cover its short-term debts, while the quick ratio offers a more stringent measure by excluding inventory.

b. Profitability Ratios

Profitability ratios assess a company’s ability to generate earnings relative to its sales, assets, or equity. Common profitability ratios are:

- Net Profit Margin: Net Income / Revenue

- Return on Assets (ROA): Net Income / Average Total Assets

- Return on Equity (ROE): Net Income / Average Shareholder Equity

These ratios are particularly valuable when comparing companies within the same industry.

c. Leverage Ratios

Leverage ratios evaluate the extent of a company’s debt and its ability to manage financial risk. Examples include:

- Debt to Equity Ratio: Total Debt / Total Equity

- Interest Coverage Ratio: EBIT (Earnings Before Interest and Taxes) / Interest Expense

Leverage ratios help investors understand whether a company is over-leveraged or financially stable.

d. Efficiency Ratios

Efficiency ratios measure how effectively a company uses its assets. Important ratios in this category include:

- Inventory Turnover: Cost of Goods Sold / Average Inventory

- Asset Turnover: Revenue / Average Total Assets

These ratios are key indicators of operational efficiency.

Discounted Cash Flow (DCF) Analysis

Discounted Cash Flow (DCF) analysis is one of the most fundamental valuation methods used by investors. The DCF method estimates the value of an investment based on its future cash flows, adjusted for time value (i.e., the principle that money today is worth more than the same amount in the future).

How DCF Works:

- Forecast Cash Flows: Estimate the company’s future free cash flows, usually for the next 5-10 years.

- Discount Cash Flows: Apply a discount rate (usually the company’s weighted average cost of capital, or WACC) to account for the risk and time value of money.

- Calculate Terminal Value: Estimate the company’s value beyond the forecast period using a perpetuity growth model or exit multiple.

- Sum Up: The sum of the present value of all future cash flows gives you the company’s intrinsic value.

The DCF model is widely used to assess the valuation of stocks, bonds, and entire businesses. It’s especially valuable for evaluating companies with predictable cash flows, like utilities or mature businesses.

Earnings Per Share (EPS) and Price-to-Earnings (P/E) Ratio

Earnings Per Share (EPS) is one of the most widely reported metrics in financial analysis. It measures a company’s profitability on a per-share basis, and it’s calculated as:

- EPS = Net Income / Outstanding Shares

EPS is important because it reflects the portion of a company’s profit attributed to each outstanding share of common stock.

The Price-to-Earnings (P/E) Ratio is another crucial metric used by investors to assess stock value:

- P/E Ratio = Market Price per Share / EPS

A high P/E ratio suggests that a company’s stock is overvalued, or that investors are expecting high growth rates in the future. Conversely, a low P/E ratio may indicate undervaluation or that the company is facing difficulties.

Comparable Company Analysis (CCA)

Comparable Company Analysis (CCA) is a relative valuation technique that involves comparing a company to similar companies within the same industry. Investors use this approach to determine if a stock is undervalued or overvalued compared to its peers.

How CCA Works:

- Identify Comparables: Find similar companies in terms of size, industry, and market.

- Compare Valuation Multiples: The most common multiples used for comparison are:

- P/E Ratio

- EV/EBITDA (Enterprise Value to Earnings Before Interest, Taxes, Depreciation, and Amortization)

- P/S Ratio (Price-to-Sales)

By comparing these multiples, investors can estimate a fair value for the company in question.

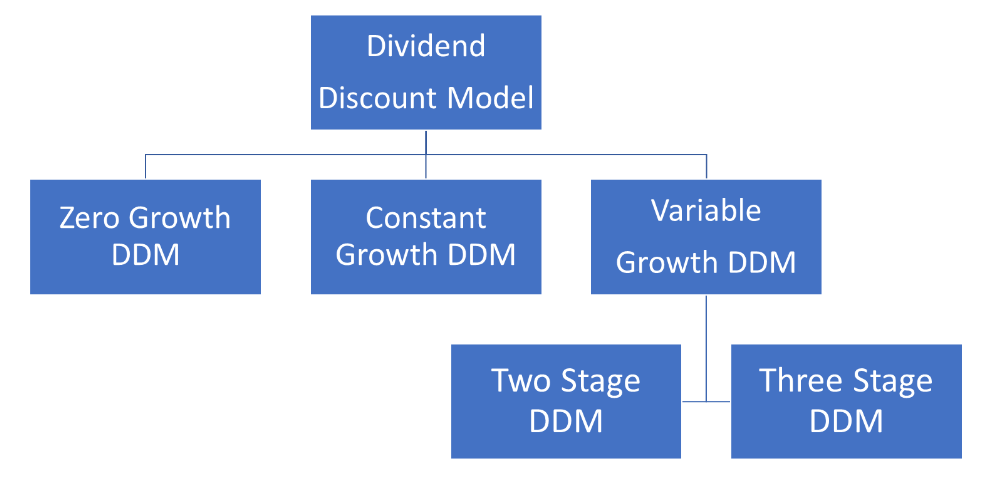

Dividend Discount Model (DDM)

The Dividend Discount Model (DDM) is another method of valuing a company, particularly for dividend-paying stocks. The DDM calculates the present value of all future dividends a company is expected to pay, assuming the dividends grow at a constant rate.

Formula for DDM:

- DDM = Dividend per Share / (Discount Rate – Dividend Growth Rate)

This model is especially useful for investors who prioritize income from dividends and want to estimate the fair value of dividend-paying stocks.

SWOT Analysis

While not strictly a financial metric, SWOT analysis is a strategic tool that can complement financial analysis. SWOT stands for Strengths, Weaknesses, Opportunities, and Threats, and it’s used to evaluate both the internal and external factors that can affect a company’s financial health.

Example:

- Strengths: Strong brand, robust cash flow, dominant market position.

- Weaknesses: High debt, dependence on a single market.

- Opportunities: New product launches, market expansion.

- Threats: Economic downturns, regulatory changes, competition.

By understanding these qualitative factors, investors can make more informed decisions about the risks and rewards associated with investing in a particular company.

Financial Forecasting and Budgeting

Financial forecasting and budgeting are critical techniques for assessing the future financial performance of a company. Forecasting involves predicting future revenues, expenses, and cash flows based on historical data and market trends.

Key Steps in Financial Forecasting:

- Review Historical Data: Analyze past financial statements to spot trends.

- Consider Market Trends: Take into account external factors like economic conditions, industry growth, and competition.

- Create Scenarios: Develop different scenarios (best-case, worst-case, and base-case) to account for uncertainties.

- Build Financial Models: Use Excel or other tools to create projections based on assumptions.

A solid financial forecast is vital for investors to gauge a company’s potential growth trajectory.

Conclusion

Financial analysis is a powerful tool that every investor must understand in order to make informed investment decisions. By mastering techniques like ratio analysis, DCF, and profitability metrics, you can accurately assess a company’s financial health and make predictions about its future performance. Complement these quantitative tools with strategic techniques like SWOT analysis and financial forecasting, and you’ll have a well-rounded approach to evaluating investment opportunities.

FAQs

What is the most important financial analysis technique?

- The most important technique depends on the investor’s goals, but ratio analysis is one of the most commonly used because it provides insights into a company’s liquidity, profitability, and efficiency.

How do I apply DCF in practice?

- To apply DCF, estimate a company’s future free cash flows, discount them to their present value, and sum them up. The challenge is accurately forecasting the cash flows and selecting the right discount rate.

What is a good P/E ratio?

- A “good” P/E ratio varies by industry, but a P/E under 15 is often considered low (potentially undervalued), while a P/E above 20-25 could suggest overvaluation or high growth expectations.

How can I use ratio analysis effectively?

- To use ratio analysis effectively, compare the ratios of a company to industry averages or competitors. It helps to look at multiple ratios to get a more complete picture of a company’s performance.

Can SWOT analysis replace financial analysis?

- No, SWOT analysis is a complementary tool. It’s useful for assessing qualitative factors, but financial analysis provides the quantitative data necessary to make informed investment decisions.

What is the main limitation of DCF analysis?

- The main limitation is the reliance on accurate cash flow projections, which are often speculative and can be influenced by unpredictable market conditions.

Why is forecasting important for investors?

- Forecasting helps investors predict future financial outcomes, understand potential risks, and estimate a company’s future growth, making it a valuable tool for decision-making.