Personal finance planning is one of the most important steps to achieving financial independence and stability. It involves understanding your income, expenses, savings, investments, and long-term goals. Financial planning helps you make informed decisions, avoid unnecessary debt, and save for the future. Whether you’re saving for a new home, planning for retirement, or managing day-to-day expenses, having a financial plan will guide you toward achieving your goals.

In this comprehensive guide, we’ll break down the steps you need to take in personal finance planning, highlight the tools and strategies that will help you along the way, and answer frequently asked questions. By the end of this article, you’ll have a clear roadmap to achieving your financial goals and making better financial decisions.

Key Takeaway

Mastering personal finance planning is a lifelong process. Start by assessing where you are today, set clear financial goals, and develop a plan that helps you achieve them. By making informed financial decisions and sticking to a disciplined approach, you’ll build a secure financial future. Remember, the key to success lies in consistent saving, strategic investing, and adapting your plan as life changes.

Step 1: Assess Your Current Financial Situation

Before you can start planning for the future, you need to understand where you stand financially right now. This means taking an honest look at your income, expenses, assets, and liabilities.

Track Your Income

Your income is the foundation of your personal finance plan. Whether you’re earning a salary, running a business, or working freelance, it’s important to know exactly how much money you have coming in each month. This includes wages, bonuses, rental income, side hustles, and passive income from investments.

Evaluate Your Expenses

To have a clear understanding of your financial situation, you need to track your spending habits. Look at all your expenses over the past few months and categorize them into necessary and discretionary spending.

- Necessary expenses might include rent or mortgage payments, utilities, groceries, and insurance.

- Discretionary spending includes things like entertainment, dining out, and non-essential shopping.

By evaluating your expenses, you’ll be able to identify areas where you might be overspending and can potentially cut back.

Examine Your Assets and Liabilities

Assets are anything of value you own, such as real estate, vehicles, investments, and savings. Liabilities, on the other hand, include anything you owe, like loans, credit card debt, and mortgages.

Take a full inventory of both your assets and liabilities to determine your net worth. Subtract your total liabilities from your total assets to arrive at your net worth. This will help you understand if you’re in a positive or negative financial position and will give you a clearer idea of your financial capacity for saving and investing.

Step 2: Set Clear Financial Goals

Once you’ve assessed your current financial situation, it’s time to set financial goals. Goals give you direction, motivation, and a benchmark for tracking progress. Financial goals should be SMART—Specific, Measurable, Achievable, Relevant, and Time-bound.

Short-Term Goals

These are goals that you aim to accomplish within one year. Examples of short-term goals include:

- Building an emergency fund of $1,000

- Paying off credit card debt

- Saving for a vacation

Medium-Term Goals

Medium-term goals are those that you aim to achieve within 1 to 5 years. Examples include:

- Saving for a down payment on a house

- Paying off student loans

- Starting an investment portfolio

Long-Term Goals

These are goals that take 5 years or more to accomplish. Long-term financial goals often include retirement planning, building wealth through investments, or saving for children’s education.

When setting your goals, consider your current financial situation, future earning potential, and the timeline for achieving each goal.

Step 3: Create a Budget and Stick to It

Budgeting is one of the most important aspects of personal finance planning. A budget allows you to allocate your income to cover necessary expenses, save for future goals, and avoid overspending.

Track Your Spending

Use apps, spreadsheets, or even pen and paper to track your spending. Identify where your money is going and whether you’re overspending in any particular category.

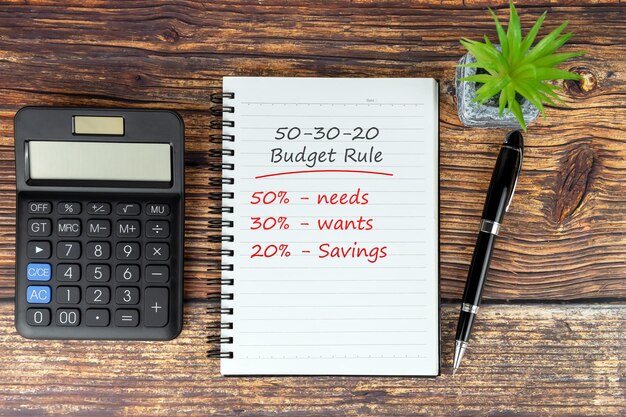

Apply the 50/30/20 Rule

One of the most popular budgeting strategies is the 50/30/20 rule:

- 50% of your income should go to needs (housing, utilities, groceries, insurance).

- 30% should be allocated to wants (entertainment, dining out, and shopping).

- 20% should go towards savings and debt repayment (emergency fund, retirement savings, and paying off loans).

This structure helps you prioritize essentials while still making room for savings and discretionary spending.

Make Adjustments

Once you’ve created a budget, ensure that you’re living within your means. If you find that your expenses are too high, consider cutting back on unnecessary spending, such as subscription services, dining out, or impulsive shopping.

Step 4: Save and Build an Emergency Fund

Life is unpredictable, and an emergency fund acts as a financial buffer for unexpected expenses, such as medical bills, car repairs, or job loss. Ideally, you should aim to save 3 to 6 months’ worth of living expenses in your emergency fund.

Start Small

If building an emergency fund seems daunting, start small. Save $500 or $1,000 to cover minor emergencies, then gradually build it up to cover 3 to 6 months’ worth of expenses.

Automate Your Savings

One of the easiest ways to save consistently is to automate transfers to your savings account. Set up automatic transfers each payday, so you don’t have to think about it.

Keep Your Emergency Fund Accessible

Your emergency fund should be kept in a savings account or money market account that is easily accessible in case of an emergency. Avoid investing it in high-risk assets like stocks, as you may need quick access to the funds.

Step 5: Eliminate High-Interest Debt

Debt, particularly high-interest debt like credit card balances, can prevent you from achieving your financial goals. Focus on eliminating this type of debt as quickly as possible.

Pay More Than the Minimum

Credit cards and personal loans often have high-interest rates. Paying only the minimum amount due will prolong the debt and increase the amount of interest you pay over time. Try to pay more than the minimum to reduce your balance faster.

Use the Debt Snowball or Avalanche Method

The debt snowball method involves paying off the smallest debt first, then moving on to the next smallest. The debt avalanche method focuses on paying off the highest-interest debt first, which is often the most cost-effective.

Consider Consolidation

If you have multiple high-interest debts, consider consolidating them into a single loan with a lower interest rate. This can simplify your payments and reduce your interest costs.

Step 6: Invest for the Future

Investing is key to building wealth and achieving long-term financial goals, such as retirement. While saving is important, investments help your money grow over time through the power of compound interest.

Start Early

The earlier you start investing, the more time your money has to grow. Even small investments made early can compound significantly over time.

Diversify Your Investments

Diversification helps reduce risk. Instead of putting all your money in one stock or asset, spread it across different investment types such as stocks, bonds, mutual funds, or real estate.

Use Retirement Accounts

Contribute regularly to retirement accounts like a 401(k), IRA, or Roth IRA. These accounts offer tax advantages, and many employers will match your contributions to a 401(k), essentially giving you free money.

Step 7: Review and Adjust Your Financial Plan

Your personal finance plan should be a living document that evolves as your life changes. Regularly reviewing your financial situation ensures that you’re staying on track with your goals.

Track Your Progress

Set aside time every month to review your budget, savings, debt, and investments. Are you meeting your goals? Are you spending within your limits? Use this information to make adjustments as needed.

Adjust for Life Changes

Life events such as marriage, having children, or a job change can significantly affect your financial situation. Adjust your goals, budget, and investments to reflect these changes.

Also Read: How To Create A Personal Finance Reddit That Works For You

Conclusion

Personal finance planning is an ongoing process that requires discipline, foresight, and a solid understanding of your financial situation. By following the steps outlined in this article—assessing your current financial situation, setting clear goals, creating a budget, saving for emergencies, eliminating debt, investing, and reviewing your plan regularly—you’ll be on the right path to financial success.

FAQs

What is the first step in personal finance planning?

The first step is assessing your current financial situation by tracking your income, expenses, assets, and liabilities.

How do I create a financial goal?

A financial goal should be specific, measurable, achievable, relevant, and time-bound (SMART). Consider both short-term and long-term goals.

What’s the best way to budget?

Using the 50/30/20 rule is a simple and effective method for budgeting. Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

How much should I save in my emergency fund?

Aim to save at least 3 to 6 months’ worth of living expenses in an easily accessible savings account.

How can I pay off debt faster?

Focus on paying off high-interest debt first, either using the debt snowball or avalanche method.

Why is investing important?

Investing allows your money to grow over time, helping you build wealth and achieve long-term financial goals, such as retirement.

How often should I review my financial plan?

It’s essential to review your financial plan monthly or quarterly to ensure you’re on track to meet your goals and adjust as needed.