The role of the Government Finance Department (GFD) is fundamental to the economic planning and management of a country. This department is responsible for overseeing the financial policies and fiscal matters that directly affect the national economy. Whether it’s through tax policy formulation, budget management, debt issuance, or public expenditure allocation, the Government Finance Department plays a central role in the economic health and stability of the nation. Understanding its contributions to national economic planning is crucial for appreciating how economic goals are met and the government’s strategies for sustainable growth.

Key Takeaways

- Fiscal Management: The Government Finance Department is responsible for preparing budgets, controlling public spending, and managing revenue collection, ensuring fiscal health.

- Debt Sustainability: The GFD manages national debt, ensuring borrowing is done responsibly and repayments remain manageable without compromising national finances.

- Economic Policy Influence: The GFD helps shape national economic policy, coordinating fiscal policies with monetary policies to control inflation and promote growth.

- Investment Promotion: Through fiscal incentives and public sector investments, the GFD fosters an environment conducive to both domestic and foreign investment.

- Public Sector Reform: The GFD is instrumental in improving governance and transparency in the public sector, minimizing corruption, and ensuring efficient use of public resources.

Introduction to the Government Finance Department (GFD)

The Government Finance Department is an essential arm of the government, often found under ministries such as the Ministry of Finance, Treasury, or Economic Affairs. Its mission is to manage public funds, advise on fiscal policies, formulate budgets, and ensure that the government operates within its financial means.

In a nutshell, the GFD ensures the efficient and effective use of public resources, facilitating fiscal stability and contributing to national economic objectives such as poverty reduction, inflation control, and infrastructure development.

The core activities of a Government Finance Department include:

- Taxation and Revenue Collection: Establishing and managing taxes that fund government expenditure.

- Government Budgeting: Formulating and implementing the national budget.

- Debt Management: Issuing government debt and managing external and internal borrowing.

- Public Expenditure: Allocating and monitoring government spending in line with national priorities.

- Economic Forecasting: Supporting long-term economic planning by projecting economic conditions and trends.

Strategic Planning in National Economic Development

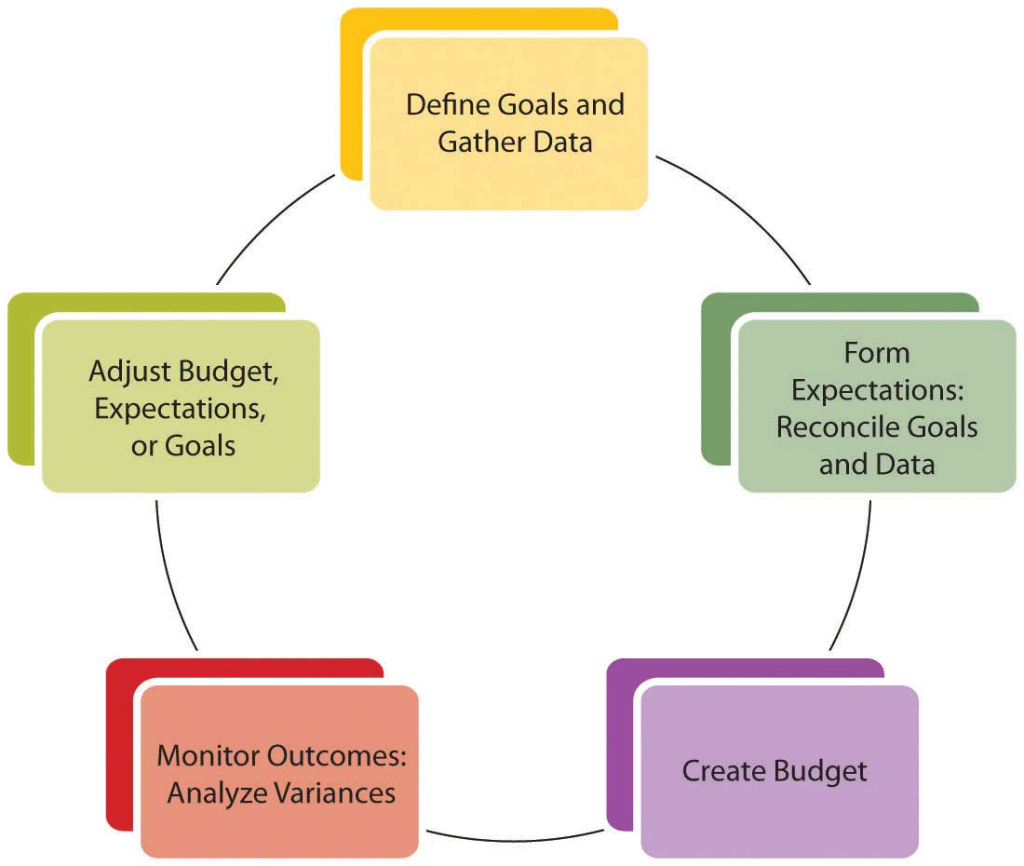

The role of the GFD in national economic planning is not just reactive but also proactive. The department works to anticipate economic challenges and plan for long-term development. This is achieved through:

- Formulating Financial Policies: These policies are designed to align the country’s fiscal health with its broader economic goals, such as improving employment, curbing inflation, and ensuring balanced economic growth.

- Budget Planning and Implementation: The GFD designs the national budget based on projected revenues, expenditures, and economic goals. Budget decisions influence public service delivery, infrastructure development, and funding for welfare programs.

- Economic Forecasting and Risk Management: The department plays a key role in providing forecasts of economic performance. These forecasts help guide economic strategies, including interest rates, inflation control, and employment policies.

Role of the Government Finance Department in Fiscal Management

Fiscal management is one of the primary functions of the Government Finance Department. This includes:

- Budget Preparation and Allocation: The GFD prepares annual budgets that allocate resources to different sectors such as healthcare, education, infrastructure, defense, and welfare. A properly structured budget ensures that the government can meet its national priorities while maintaining fiscal discipline.

- Revenue Generation: The department is responsible for designing tax systems and ensuring effective tax collection mechanisms. Efficient revenue generation allows the government to fund its programs without the need to borrow excessively. The GFD ensures that taxation is fair, transparent, and aligned with economic growth.

- Expenditure Control: The GFD is also responsible for controlling government spending. This includes assessing the efficiency of public expenditure and ensuring that funds are directed toward projects that will promote long-term development, rather than wasteful spending.

- Debt Management: One of the crucial aspects of national economic planning is managing public debt. The GFD decides on borrowing strategies, whether through bonds, loans, or other instruments, and ensures that the country’s debt remains sustainable. This involves creating a balance between borrowing for necessary investments and avoiding excessive debt that could compromise economic stability.

Influence on National Economic Policy

The Government Finance Department has a significant influence on shaping the broader economic policy. It works closely with other government departments, such as the Ministry of Planning, Industry, and Economic Development, to create policies that align with the country’s long-term goals.

- Monetary and Fiscal Policy Coordination: While the central bank handles monetary policy, the GFD collaborates closely with the central bank to ensure that fiscal policies, such as taxation and spending, are consistent with monetary policy goals. Coordination between these two entities helps in controlling inflation, managing currency stability, and promoting economic growth.

- Stimulating Investment: The GFD designs fiscal policies that encourage both domestic and foreign investment. By offering tax incentives, reducing business taxes, and investing in critical infrastructure, the department fosters an environment conducive to private-sector growth and investment.

- Ensuring Sustainable Growth: A critical role of the GFD is to ensure that economic growth is inclusive and sustainable. This involves creating policies that stimulate job creation, boost productivity, and enhance human capital, while also managing environmental and social risks.

Public Sector Reform and Governance

The Government Finance Department is not just about managing finances; it also plays a role in improving public sector governance. This includes the introduction of reforms to ensure that public funds are used efficiently and transparently. Key areas of focus include:

- Anti-Corruption Measures: The GFD works to implement policies and procedures that minimize corruption and ensure transparency in the allocation and spending of public funds.

- Public Financial Management (PFM): This involves the improvement of systems that track, monitor, and evaluate government spending. The department is responsible for ensuring that PFM systems are robust and effective.

- Human Resources Development: The GFD ensures that the civil service has the necessary skills to handle public finances, supporting training programs and knowledge-sharing initiatives.

Further Exploration of Government Finance Department’s Key Functions

The Government Finance Department (GFD) serves as a pivotal institution in shaping the fiscal health of a nation. Beyond its fundamental tasks of managing budgets, revenue, and debt, it plays several other important roles that influence the broader economic landscape.

Public Debt Issuance and Management

Public debt is an essential tool for financing government activities, especially when current revenues are insufficient to cover the costs of public services or large infrastructure projects. The GFD decides when and how the government should borrow from external or domestic sources. The GFD must carefully assess the country’s debt sustainability and avoid an excessive debt burden that could undermine future economic stability.

- Types of Debt Instruments: Governments issue bonds, treasury bills, and loans to finance national programs. The GFD manages these debt instruments’ issuance to ensure they align with the country’s fiscal and monetary policies.

- Debt Sustainability: It is the responsibility of the GFD to keep the debt-to-GDP ratio at a level that allows for manageable debt servicing without endangering the government’s ability to meet other priorities.

Revenue Forecasting and Tax Policy Formulation

The GFD plays a significant role in forecasting future government revenue and designing tax policies. This process includes determining the best sources of tax revenue and how to optimize tax rates to ensure that the government can fund necessary programs while avoiding economic distortion.

- Tax Collection Strategies: The GFD develops tax systems that promote compliance while ensuring fairness and efficiency. This may include direct taxes such as income tax and corporate tax, and indirect taxes like VAT (value-added tax) or excise taxes.

- Dynamic Adjustments: Tax policy may be adjusted according to economic performance. In times of economic expansion, governments might increase revenues through higher tax rates or improved tax compliance; during economic downturns, tax relief measures might be introduced to stimulate growth.

Strategic Allocation of Expenditures

The GFD ensures that government spending is aligned with national priorities. This involves allocating funds to key areas such as healthcare, education, infrastructure, and security. The department needs to ensure that expenditures reflect strategic long-term goals, including sustainable development, poverty alleviation, and technological advancements.

- Infrastructure Development: Allocating resources to infrastructure is crucial in fostering economic growth. Building roads, energy systems, and communication networks enables businesses to thrive, creates jobs, and improves the standard of living.

- Human Development: The GFD also focuses on budgeting for social programs, including education and healthcare, which are essential for improving human capital and ensuring long-term economic development.

Managing Economic Risks and Challenges

The GFD’s responsibilities extend to mitigating economic risks and challenges. It assesses risks such as inflation, recession, and global financial instability, and works to put in place financial safeguards that can help buffer the economy in times of crisis.

- Counter-Cyclical Measures: The GFD adopts fiscal policies that can help stabilize the economy during periods of economic volatility. For instance, during economic downturns, the GFD may increase government spending and decrease taxes to stimulate economic activity.

- Contingency Planning: In the event of an economic shock (such as a natural disaster or global financial crisis), the GFD develops contingency plans to ensure that public funds can be redirected to immediate recovery needs while keeping the economy stable.

Global Context and the GFD’s Role in International Economic Relations

In today’s globalized world, the Government Finance Department must navigate international economic relations and consider global trends when planning national economic strategies. The GFD’s role extends beyond domestic issues to encompass global fiscal policies and international trade dynamics.

Managing Foreign Relations and Investments

The GFD plays an essential role in fostering foreign relations by participating in international trade agreements, securing foreign direct investment (FDI), and negotiating with international financial organizations such as the World Bank and International Monetary Fund (IMF).

- Foreign Aid and Assistance: In developing nations, the GFD may also oversee foreign aid programs, ensuring that foreign funds are allocated efficiently and transparently to meet development goals.

- Global Economic Agreements: The GFD ensures that fiscal policies are aligned with international economic commitments and trade agreements, such as those under the World Trade Organization (WTO), that influence tax policies and tariffs.

Economic Diplomacy and Debt Management

International financial institutions often provide loans or grants to governments for specific projects, such as infrastructure or healthcare development. The GFD manages these loans, negotiating repayment terms, and making sure that the country does not accumulate unmanageable external debt.

- Managing Currency Exchange and Inflation: Currency fluctuations and external trade relations can have a major impact on the national economy. The GFD works closely with central banks and monetary authorities to manage these issues, ensuring currency stability and controlling inflation.

The Role of the Government Finance Department in Economic Diversification

In many developing countries, the GFD plays a crucial role in supporting economic diversification. By managing finances and reallocating resources strategically, the department helps economies transition from being dependent on a single industry (e.g., oil or agriculture) to being more diversified and resilient to external shocks.

- Investing in New Sectors: The GFD can facilitate investments in sectors such as technology, renewable energy, manufacturing, and services. This diversification ensures the country is less vulnerable to price fluctuations in any one commodity or sector.

- Incentivizing Innovation and Entrepreneurship: The GFD works on fiscal policies that foster innovation and entrepreneurship, helping the country move towards a knowledge-based economy.

The GFD’s Role in Responding to Economic Crises

The Government Finance Department is at the forefront when responding to economic crises, whether they are triggered by domestic issues, such as a financial meltdown, or global shocks, like a recession or natural disaster. In these instances, the GFD takes critical actions to stabilize the economy and restore fiscal health.

Crisis Management and Emergency Budgeting

During times of economic crisis, the GFD may need to rapidly adjust the national budget to allocate more funds for recovery efforts. This could involve reallocating spending from non-essential projects to emergency relief, healthcare, or financial support programs aimed at mitigating the effects of the crisis.

- Short-Term Fiscal Stimulus: During crises like recessions, the GFD can implement fiscal stimulus measures, such as increasing government spending or cutting taxes to inject capital into the economy and stimulate demand.

- Targeted Relief Programs: The department might allocate funds for targeted relief programs, such as unemployment benefits or subsidies for businesses facing temporary closures.

Debt Restructuring and Financing During Crises

In times of financial difficulty, countries may experience liquidity challenges, which makes managing public debt even more complicated. The GFD may engage in debt restructuring, renegotiating terms with creditors, or seeking relief from international financial organizations like the IMF.

- Debt Rescheduling: The GFD can engage in debt rescheduling to give the government more time to repay its obligations, providing temporary relief without harming the country’s reputation in international financial markets.

- Emergency Funding and Assistance: During a crisis, the GFD may also look for emergency funding options from international lenders or explore government-issued bonds to address short-term liquidity gaps.

Mitigating Long-Term Risks

The department’s role also involves planning for future economic shocks by establishing fiscal reserves or “rainy day” funds. By setting aside capital during periods of economic growth, the GFD ensures that funds are available to handle unexpected financial challenges.

Fiscal Transparency and Accountability in the Government Finance Department

An essential function of the GFD is ensuring transparency and accountability in the use of public funds. This is critical to maintaining public trust and reducing the risk of corruption and inefficiency in government spending.

Open Budgeting Process

One of the most effective ways to achieve transparency is by adopting an open budgeting process. The GFD facilitates a system where the public has access to budgetary decisions and details regarding how taxpayer money is spent. This allows citizens, civil society organizations, and the media to scrutinize how government resources are allocated.

- Public Consultations: Some countries go a step further by organizing public consultations, where citizens and stakeholders can give feedback on proposed budgets and government spending priorities.

- Online Budget Portals: Many governments have created online platforms where citizens can track government spending in real-time, enhancing transparency and trust.

Auditing and Oversight

To ensure that public finances are used appropriately, the GFD works closely with national audit institutions and external auditors. Regular audits help ensure that the government’s financial actions are in line with established legal and regulatory frameworks.

- Independent Oversight: Many GFDs are subject to oversight from independent auditing bodies or parliamentary committees that review government spending, examine financial statements, and recommend corrective actions if necessary.

- Anti-Corruption Measures: To ensure that public finances are not misused, the GFD works with agencies focused on anti-corruption to monitor public spending and prevent mismanagement or embezzlement of funds.

The GFD and Sustainable Economic Development

Sustainable development is a growing priority for governments globally, and the GFD plays a key role in integrating sustainability into fiscal planning. This involves balancing short-term economic needs with long-term environmental, social, and economic objectives.

Green Finance and Sustainable Investments

The GFD is increasingly responsible for fostering green finance—investment in sustainable industries and environmental projects that contribute to climate change mitigation. This involves directing public funds toward renewable energy projects, sustainable infrastructure, and promoting green business initiatives.

- Funding Renewable Energy: Governments are looking to diversify their energy mix by investing in renewable sources such as wind, solar, and hydroelectric power. The GFD manages the funding and fiscal policies that make these investments feasible.

- Socially Responsible Investments: In some cases, governments provide tax incentives or grants to businesses that prioritize social responsibility, ensuring that economic growth also improves social outcomes, such as reducing inequality or supporting marginalized communities.

Economic Sustainability in Policy Formulation

The GFD helps integrate sustainability principles into economic policy, creating strategies that balance economic development with environmental protection. By incorporating sustainability goals into the national budget, the GFD ensures that government spending promotes long-term well-being.

- Sustainable Agriculture and Infrastructure: For instance, the GFD may fund sustainable agriculture programs or prioritize building infrastructure projects that are environmentally friendly and reduce the country’s carbon footprint.

- Climate-Resilient Investments: Investing in climate-resilient infrastructure, such as flood defenses, water management systems, and disaster-resistant buildings, ensures that the country is prepared for the long-term impacts of climate change.

Also Read: How Do Public Finances Impact The Economic Stability Of A Country?

Conclusion

The Government Finance Department is a cornerstone of national economic planning. It is responsible for managing the public finances, formulating the national budget, controlling government spending, and coordinating fiscal policies. Through its actions, the department helps to maintain economic stability, promote growth, and achieve the nation’s long-term objectives. By focusing on sustainable fiscal management, debt control, and efficient resource allocation, the GFD plays a crucial role in determining the economic trajectory of the country.

With its influence over national policy, the GFD ensures that the government’s financial activities align with both domestic priorities and global economic trends. As such, it is not only a financial manager but a strategic planner that contributes to a country’s overall economic well-being.

Frequently Asked Questions (FAQs)

What does the Government Finance Department do?

The Government Finance Department is responsible for managing a country’s finances, including tax policy, government spending, debt management, and budgeting, to ensure fiscal stability and promote economic growth.

How does the Government Finance Department contribute to national economic planning?

By preparing national budgets, forecasting economic conditions, managing government revenue and expenditure, and formulating fiscal policies, the GFD supports the country’s economic goals and ensures sustainable growth.

What role does the Government Finance Department play in debt management?

The GFD is responsible for issuing government debt, managing internal and external borrowing, and ensuring that the country’s debt remains sustainable without compromising economic stability.

How does the GFD ensure economic stability?

Through fiscal management (budget preparation, revenue generation, expenditure control), debt management, and policy coordination with other economic entities, the GFD contributes to maintaining stable economic conditions.

What is fiscal policy, and how does the GFD influence it?

Fiscal policy refers to government spending and taxation decisions. The GFD shapes fiscal policy by designing tax systems, allocating resources in the national budget, and managing government debt.

How does the GFD promote investment in the economy?

The GFD fosters an environment for investment by offering tax incentives, reducing business taxes, and allocating funds to infrastructure projects that stimulate both domestic and foreign investment.

How does the Government Finance Department collaborate with the central bank?

The GFD works closely with the central bank to ensure that fiscal policies align with monetary policies, such as controlling inflation, stabilizing the currency, and promoting economic growth.