Foreign finance plays an essential role in the dynamics of international trade and investment. It serves as a key driver of global economic activity, facilitating trade between countries, promoting investment, and ensuring economic growth. As the global economy becomes increasingly interconnected, the importance of foreign finance cannot be overstated. It helps fill funding gaps, accelerates economic growth in emerging markets, and fosters international collaboration.

Foreign finance can come in various forms, including foreign direct investment (FDI), foreign portfolio investment (FPI), and loans provided by international financial institutions such as the World Bank and the International Monetary Fund (IMF). Each of these financial mechanisms plays a unique role in shaping international trade and investment patterns.

In this article, we will delve deep into the different forms of foreign finance, how they contribute to international trade and investment, the benefits and risks they bring, and how they influence economic stability across borders.

Key Takeaways

- Foreign finance drives growth: It provides the capital needed for infrastructure, technology, and innovation, which fuels economic growth and international trade.

- Risks need to be managed: Over-reliance on foreign debt, currency fluctuations, and speculative investments can destabilize trade and economies.

- FDI enhances competitiveness: Foreign direct investment allows countries to increase production, create jobs, and boost exports.

- Trade financing supports international transactions: Instruments like letters of credit and trade credit reduce the risks associated with cross-border trade.

- Global integration depends on finance: Foreign finance fosters economic interdependence, enhancing opportunities for countries to participate in global trade networks.

The Various Forms of Foreign Finance

Foreign finance can be classified into several categories, each playing a different yet interconnected role in international trade and investment. These forms include:

- Foreign Direct Investment (FDI):

- Foreign Direct Investment refers to investments made by foreign entities or individuals in businesses or assets in another country. This is typically a long-term investment, and it allows the foreign investor to take a significant ownership stake in a company. FDI is often seen as a vital source of capital for developing countries, providing funds for infrastructure, manufacturing, and technology.

- The influx of FDI has a profound impact on international trade. It helps expand production capabilities, creates jobs, improves technology, and fosters innovation. As a result, FDI contributes to increased trade between countries by boosting both the supply and demand for goods and services.

- Examples of FDI include multinational corporations building factories abroad or a foreign company acquiring local businesses in a different market.

- Foreign Portfolio Investment (FPI):

- Foreign Portfolio Investment involves investments in financial assets such as stocks, bonds, and other securities in a foreign country. Unlike FDI, FPI does not involve direct control over the companies in which investments are made. Instead, it provides liquidity to financial markets and allows investors to diversify their portfolios internationally.

- FPI plays an essential role in enhancing liquidity and deepening financial markets in host countries. It also contributes to the stability of global capital flows by providing foreign capital to markets that may otherwise be limited in access to global funds. FPI facilitates international trade by boosting economic liquidity, which, in turn, supports the growth of businesses engaged in international trade.

- International Loans and Credit:

- Many countries rely on loans and credit facilities provided by international institutions such as the IMF, the World Bank, or bilateral agreements with foreign governments. These loans help countries manage trade deficits, balance payments, and promote domestic economic development.

- When countries borrow from international financial institutions, the funds are often used to finance infrastructure projects, improve public services, or stabilize the economy. By promoting stability, loans from foreign creditors enhance trade by ensuring that the local economy remains robust enough to support international transactions.

- Trade Financing:

- Trade financing refers to the various methods and instruments used to support international trade transactions. This includes trade credit, letters of credit, export financing, and other financial instruments that help bridge the gap between sellers and buyers in cross-border trade.

- Foreign finance in trade allows businesses to expand internationally by providing the necessary funding for raw materials, production, and shipment costs. This type of finance also lowers the risks of non-payment and makes trade between countries smoother and more reliable.

How Foreign Finance Drives International Trade

Foreign finance plays an indispensable role in facilitating global trade by enabling countries to access capital markets and invest in growth opportunities. Below are some key ways in which foreign finance contributes to international trade:

- Capital Access for Developing Countries:

- Many developing countries face significant challenges in securing the capital needed to improve infrastructure and industries that support trade. Foreign finance bridges this gap, providing the necessary funding for projects such as building ports, upgrading transportation networks, and improving manufacturing capabilities.

- The availability of foreign finance allows these countries to increase their exports and enhance their competitiveness in the global market, leading to a higher volume of trade.

- Improving Technological Advancements and Innovation:

- Foreign investments, particularly FDI, often bring advanced technology and innovative business practices to host countries. As foreign investors establish operations in a new country, they transfer knowledge, technology, and skills, which improve productivity and efficiency.

- The technological advancements that come with foreign finance enhance the quality and competitiveness of goods and services, making it easier for countries to participate in global trade. Additionally, this fosters greater integration into the global supply chain.

- Facilitating Cross-Border Transactions:

- Foreign finance provides businesses with access to international funding, ensuring that they have the capital to engage in cross-border transactions. This could involve financing the production of goods that will be exported or supporting the establishment of joint ventures in foreign markets.

- Furthermore, trade financing instruments like letters of credit and trade credit help mitigate the risks associated with international trade. These instruments provide security and financial backing for transactions, ensuring smoother exchanges between parties in different countries.

- Currency Stability and Exchange Rate Support:

- Foreign finance, particularly foreign exchange reserves held by central banks, helps stabilize a country’s currency. By having access to foreign currencies and international financial instruments, countries can manage exchange rate fluctuations, which in turn facilitates trade.

- A stable currency reduces uncertainty in international trade, as businesses can better predict costs and revenues associated with foreign transactions. When exchange rates are volatile, international trade becomes more expensive and less predictable, which can dampen trade activity.

- Boosting Investor Confidence:

- Foreign investments in a country can improve investor confidence, signaling economic stability and growth potential. As investor confidence grows, it attracts more foreign capital, which fosters economic growth and creates a positive feedback loop of increased trade and investment.

- Countries with strong foreign finance inflows tend to experience more stable economies and, therefore, engage in greater international trade. By maintaining a favorable investment climate, these countries ensure a continual flow of resources to support their trade activities.

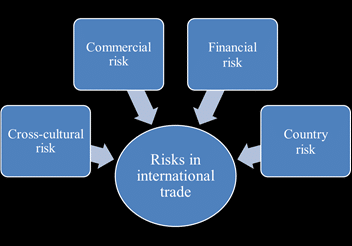

Challenges and Risks of Foreign Finance in Trade

While foreign finance plays a critical role in promoting international trade, it is not without its risks and challenges. These risks must be carefully managed to ensure that foreign finance contributes to, rather than detracts from, global trade growth.

- Over-reliance on Foreign Debt:

- Countries that borrow heavily from foreign creditors may face difficulties repaying their loans if economic conditions worsen. Excessive debt burdens can lead to financial instability, which in turn can disrupt international trade. Developing nations, in particular, are at risk of falling into debt traps if they rely too much on loans for trade-related projects.

- Currency Fluctuations and Exchange Rate Risks:

- Currency volatility can pose significant challenges for businesses engaged in international trade. When the value of a country’s currency fluctuates rapidly, it can make imported goods more expensive and reduce the competitiveness of exports. Foreign finance often involves currency exposure, and countries must carefully manage these risks to protect their trade balance.

- Influx of Short-Term Speculative Investments:

- While FDI can be a stable source of capital, short-term speculative investments can be destabilizing. Foreign portfolio investments (FPI), in particular, can lead to rapid shifts in capital flows, which might result in sudden financial crises when large numbers of investors decide to withdraw their investments.

- Speculative investments can also create bubbles in asset prices, particularly in real estate and stock markets, which can lead to instability and hamper trade growth.

- Political and Geopolitical Risks:

- Foreign finance is susceptible to geopolitical risks and political instability in the host country. Trade sanctions, tariff wars, and changes in government policies can have a direct impact on the availability and flow of foreign finance, which in turn affects international trade.

- Political instability can make a country less attractive to foreign investors, which can deter both foreign direct and portfolio investments. Trade disruptions due to political factors can have lasting impacts on international trade relationships.

- Inequality and Dependency:

- Foreign finance, if not properly managed, can exacerbate economic inequality. Wealthier countries or multinational corporations may benefit disproportionately from foreign investments, leaving local businesses in developing countries at a disadvantage.

- In some cases, foreign finance can create a dependency on external capital, which may make it harder for countries to develop self-sustaining economies.

Long-Term Implications of Foreign Finance in Trade and Investment

The long-term effects of foreign finance on international trade and investment can significantly shape a nation’s economy, its role in the global market, and its ability to weather economic downturns. Let’s explore some of the broader, long-term implications:

1. Sustained Economic Growth

Foreign finance helps maintain sustained economic growth by providing countries with the capital they need to develop infrastructure, improve industries, and create job opportunities. When countries experience steady foreign investment, they are better positioned to meet the growing demands of international trade, resulting in stronger economies. A long-term influx of foreign capital ensures that businesses can scale up operations, thus increasing both production capacity and export potential.

- Example: Countries like China and India have significantly benefited from foreign investments over the years. By building strong manufacturing sectors through foreign direct investments (FDI), these countries have become key players in global trade.

2. Access to Technology and Knowledge Transfer

Foreign finance facilitates the transfer of not only capital but also technology and knowledge. Through FDI, foreign investors introduce advanced technologies, research, and innovative practices that local businesses can adopt. Over time, this can lead to greater productivity and competitiveness within local industries, enhancing a country’s ability to compete in international markets.

- Example: The rapid expansion of the telecommunications sector in many developing countries, such as Vietnam and Kenya, has been largely driven by foreign investments. These investments have helped local companies acquire cutting-edge technology and infrastructure that would otherwise have been unattainable.

3. Strengthening Global Financial Integration

Foreign finance is essential for the integration of countries into the global financial system. It helps reduce the fragmentation of global trade by providing countries with the tools they need to participate in international markets. Access to foreign finance opens up new avenues for international collaboration, fostering smoother and more interconnected trade relationships.

- Example: The European Union (EU) has seen tremendous economic growth and trade integration partly because of coordinated foreign financial flows among member states. These cross-border financial activities have bolstered trade by ensuring that nations have the capital and resources to engage with one another efficiently.

4. Infrastructure Development for Trade Facilitation

Infrastructure development is a critical driver of trade, and foreign finance often supports the construction of infrastructure projects that make international trade more efficient. Investments in transportation (airports, roads, railways), energy (power plants, electricity grids), and communication (internet, mobile networks) create the foundation for increased cross-border trade.

- Example: The construction of large ports in countries such as Singapore and the UAE has been possible due to foreign financing. These ports play a crucial role in facilitating international trade, providing fast and efficient movement of goods across borders.

5. Encouraging Long-Term Stability

Foreign finance often leads to the establishment of more robust financial systems and institutions in developing countries, which can contribute to greater economic stability. This stability, in turn, ensures that countries can maintain consistent and reliable trade relationships with international partners. Long-term financial support from foreign investors fosters resilience against economic crises.

- Example: In South Korea, the influx of foreign finance during the 1990s helped modernize the country’s economy, contributing to a stable, open economy that could weather global economic shocks.

Emerging Markets and Foreign Finance

Emerging markets are often highly reliant on foreign finance, which plays a crucial role in their integration into the global economy. These markets typically have growing economies but require external capital to scale their industries, foster technological advancements, and build necessary infrastructure. Foreign finance allows these countries to access resources they might not have within their borders, helping them become competitive players in global trade.

1. Unlocking Potential in Emerging Economies

Foreign finance helps unlock the potential of emerging markets by giving local businesses access to capital that would otherwise be unavailable. This funding is crucial for the development of industries such as manufacturing, agriculture, and services, which are key components of international trade. By tapping into foreign capital, these economies can better compete with developed countries in global markets.

- Example: The rise of Brazil as a major agricultural exporter has been partially driven by foreign investments, allowing the country to scale its farming operations and increase exports of goods such as soybeans, coffee, and beef.

2. Fostering Regional Economic Integration

Foreign finance also promotes regional economic integration in emerging markets. As countries within a region pool their financial resources and collaborate on investment projects, it can strengthen the region’s overall trade relationships. Regional agreements and alliances, supported by foreign finance, can create opportunities for businesses to expand across borders, driving regional growth and stability.

- Example: The ASEAN Economic Community (AEC) has supported the economic integration of Southeast Asian countries, with foreign finance playing a key role in funding infrastructure projects and improving trade flows within the region.

3. Addressing Gaps in Infrastructure

Emerging markets often face significant gaps in infrastructure that hinder trade and investment. Foreign finance can help address these challenges by funding infrastructure projects such as ports, airports, highways, and telecommunications networks. This infrastructure, in turn, facilitates smoother trade transactions and connects emerging markets with the rest of the world.

- Example: In Africa, projects funded by foreign finance, such as the Mombasa-Nairobi Standard Gauge Railway in Kenya, have helped improve trade efficiency across the continent by providing faster and more reliable transportation routes.

Challenges for Multinational Corporations

While foreign finance can unlock opportunities for growth and investment, it also presents several challenges, particularly for multinational corporations (MNCs) that engage in international trade and investment. These challenges include:

Navigating Political and Regulatory Risks

Multinational corporations often face political instability or sudden regulatory changes when they invest in foreign markets. The risk of expropriation, changes in tax laws, or the imposition of trade barriers can make foreign investments volatile. MNCs must navigate these risks by securing insurance, conducting thorough market analysis, and developing contingency plans.

- Example: In Venezuela, many foreign oil companies faced significant risks when the government nationalized oil assets, affecting the investments of multinational corporations in the region.

Currency and Exchange Rate Fluctuations

Foreign finance often involves currency exposure, which can lead to losses if exchange rates fluctuate significantly. Multinational corporations must adopt strategies such as hedging to protect themselves from adverse currency movements that may erode their profits or increase operational costs.

- Example: In 1997, the Asian Financial Crisis saw dramatic currency devaluations across Southeast Asia, which hurt many foreign investors and multinational corporations that were heavily exposed to these currencies.

Competition and Market Saturation

Multinational corporations often face fierce competition when entering foreign markets, particularly when they are trying to establish a presence in emerging economies. Foreign finance can provide the capital necessary to compete, but market saturation or local competition can limit returns on investment.

- Example: In India, foreign retailers such as Walmart and Carrefour face stiff competition from well-established local retailers and e-commerce platforms like Flipkart and Amazon India.

Also Read: How Does Global Finance Impact Economic Stability Around The World?

Conclusion

Foreign finance plays a pivotal role in driving international trade and investment. It supports global economic integration by facilitating cross-border capital flows, enhancing technological innovation, and enabling countries to manage their trade imbalances. Through various mechanisms such as foreign direct investment, foreign portfolio investment, and international loans, foreign finance fuels the growth of global trade.

While there are risks associated with foreign finance, careful management and sound policy frameworks can ensure that these risks are mitigated, allowing countries to reap the benefits of increased trade and investment. As global trade continues to expand, foreign finance will remain an essential tool in promoting economic stability and fostering growth across borders.

FAQs

How does foreign finance improve trade between countries?

Foreign finance improves trade by providing the capital needed for infrastructure development, enhancing technological capabilities, and increasing investor confidence. This enables businesses to expand their reach and participate more actively in global trade.

What is the difference between foreign direct investment and foreign portfolio investment?

Foreign direct investment involves long-term investments where the investor takes an ownership stake in a company, while foreign portfolio investment involves short-term investments in financial assets such as stocks and bonds without direct ownership.

What role do international financial institutions play in foreign finance?

International financial institutions like the IMF and World Bank provide loans and technical assistance to countries, helping them manage trade imbalances, stabilize currencies, and finance infrastructure projects that boost international trade.

Can foreign finance lead to economic instability?

Yes, excessive reliance on foreign finance, such as high levels of foreign debt or speculative investments, can lead to financial instability and disrupt international trade.

How do exchange rates affect foreign finance in trade?

Exchange rates influence the cost of imports and exports, making it essential for businesses involved in international trade to manage currency risks. Stable exchange rates reduce uncertainty and promote smooth trade operations.

What are the benefits of trade financing?

Trade financing provides businesses with the capital needed to engage in international transactions, reduces the risk of non-payment, and improves liquidity in global trade markets.

How can countries mitigate the risks associated with foreign finance?

Countries can mitigate risks by diversifying their sources of finance, managing foreign debt responsibly, maintaining stable exchange rates, and creating favorable business environments that attract long-term investments.